Table of Contents

- Introduction

- Background of ‘Bharat’ Taxi

- The Cooperative Structure Behind the Project

- Objectives and Vision

- How ‘Bharat’ Taxi Differs from Existing Ride-Hailing Services

- Funding and Financial Framework

- Membership Drive and Early Adoption

- Technology Development Plans

- Strategic Partnerships and Advisory Support

- Market Potential and Target Areas

- Impact on Drivers and Employment

- Benefits for Consumers

- Challenges and Risks

- Policy Support and Government Role

- Future Outlook

- Key Takeaways Table

1. Introduction

India’s ride-hailing market is set for a new entrant with a different model. ‘Bharat’ Taxi, formed by a consortium of cooperatives, aims to challenge Ola and Uber. The project has an authorised capital of ₹300 crore and has begun onboarding drivers. Its goal is a driver-owned, community-focused service that pairs an app with cooperative ownership.

2. Background of ‘Bharat’ Taxi

The service is registered as Multi-State Sahakari Taxi Cooperative Ltd. Registration took place on June 6, 2025. The idea grew from work on the National Cooperative Policy to widen cooperative roles in urban services. Union Cooperation Minister Amit Shah flagged the concept, and leading cooperative bodies moved fast to build it.

3. The Cooperative Structure Behind the Project

Eight founding institutions back the venture:

- National Cooperative Development Corporation (NCDC)

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- Gujarat Cooperative Milk Marketing Federation (GCMMF – Amul)

- Krishak Bharati Cooperative Limited (KRIBHCO)

- National Bank for Agriculture and Rural Development (NABARD)

- National Dairy Development Board (NDDB)

- National Cooperative Exports Limited (NCEL)

- A regional cooperative partner

Ownership sits with cooperatives, not private investors. The government holds no equity, so members retain decision power.

4. Objectives and Vision

The cooperative sets clear aims:

- Give drivers ownership and a vote in key matters.

- Offer affordable fares without heavy surcharges.

- Build a nationwide network that covers towns beyond metros.

- Cut middlemen commissions with fair, open pricing.

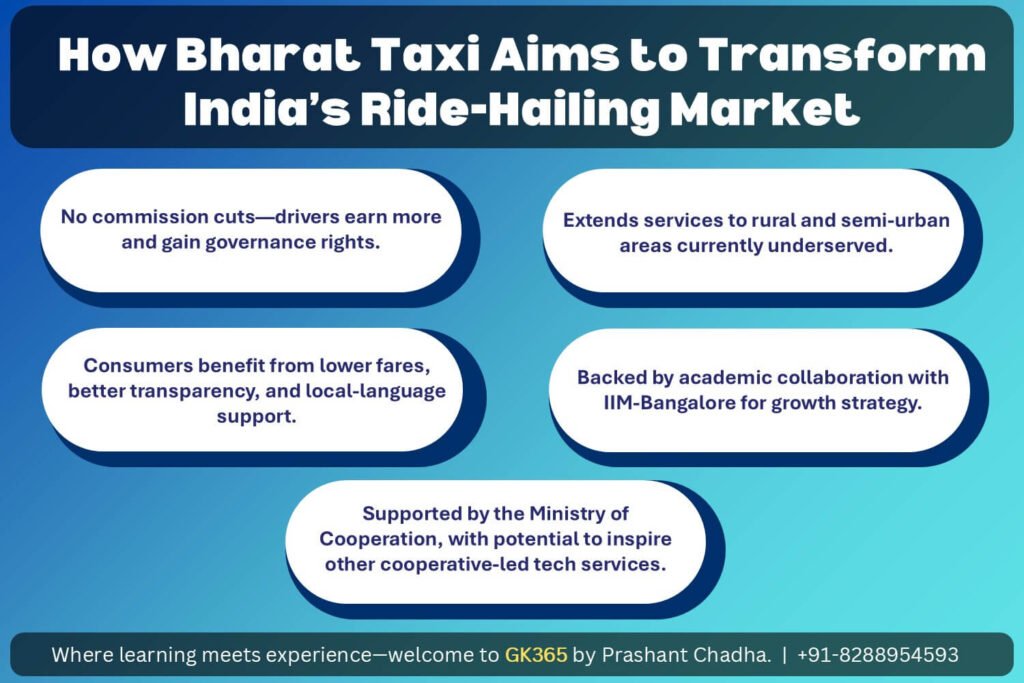

5. How ‘Bharat’ Taxi Differs from Existing Ride-Hailing Services

The model departs from standard aggregator practice. Ola and Uber take commissions that reduce driver earnings. ‘Bharat’ Taxi plans to share profits with members and keep fares open and stable. It avoids sudden surge pricing and extends service to rural and semi-urban areas.

6. Funding and Financial Framework

Authorised capital stands at ₹300 crore from the founding cooperatives. The plan avoids venture capital and private equity. That choice eases short-term return pressure and supports steady growth.

7. Membership Drive and Early Adoption

Driver enrolment has started across states. The first 200 drivers come from Delhi, Gujarat, Uttar Pradesh, and Maharashtra. A national campaign targets taxi operators and independents. Partnerships with regional taxi unions will help expand coverage.

8. Technology Development Plans

A tender is in progress to select a technology partner for the app. Launch is planned for late 2025. Planned features include a uniform interface, clear fare display, digital payments, and support for multiple Indian languages. One app will work across states, not city by city.

9. Strategic Partnerships and Advisory Support

A technology consultant is guiding software work. The Indian Institute of Management, Bangalore is shaping marketing, customer growth, and expansion plans. This link brings structured planning to a member-driven body.

10. Market Potential and Target Areas

India’s ride-hailing market is large and growing. Metros lead usage, yet many small towns lack app-based options. ‘Bharat’ Taxi plans to target these gaps, add local-language support, and set up cooperative service stations for maintenance and driver support.

11. Impact on Drivers and Employment

Drivers gain a share of profits and a role in governance. They avoid high commissions. Cooperative links can offer benefits such as insurance and loans. Better earnings and support may lift retention.

12. Benefits for Consumers

Passengers can expect lower fares as commissions shrink. Pricing stays clear. Coverage expands into areas other apps often skip. Links with cooperative banks can ease payments and refunds.

13. Challenges and Risks

The venture faces strong brands with deep loyalty. A national tech platform must scale and stay reliable. Governance across many cooperatives needs careful design. Service quality must remain steady across varied regions.

14. Policy Support and Government Role

The Ministry of Cooperation supports wider cooperative roles in digital services. Clear urban transport rules will matter for fair competition. Direct government funding is absent, which keeps member control intact.

15. Future Outlook

If the model works, similar cooperative services could emerge in food delivery, logistics, and local commerce. With an app launch slated for late 2025 and steady driver onboarding, ‘Bharat’ Taxi aims to become a visible alternative to private aggregators. Industry and policy watchers will track its progress.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Launch & Structure | Initiated in June 2025 as Multi-State Sahakari Taxi Cooperative Ltd, backed by eight cooperative giants. |

| Ownership Model | 100% cooperative-owned; no government equity; drivers participate in governance. |

| Core Goals | Driver welfare, affordable fares, rural access, and transparent pricing. |

| Technology Roadmap | Multilingual app to launch in late 2025 with unified national interface. |

| Driver Benefits | No commissions, profit-sharing, insurance, loans, and decision-making power. |

| Consumer Benefits | Lower fares, no surge pricing, regional language access, and better transparency. |

| Challenges | Competing with Ola/Uber, tech scalability, and cooperative governance. |

| Policy Support | Encouraged by Ministry of Cooperation but operates without direct government funding. |