“Made in India iPhones reflect not just a product launch but a shift in global manufacturing geography — with India now at the center.” — On Foxconn’s Bengaluru facility

Foxconn’s new factory in Devanahalli, Bengaluru has started producing the iPhone 17 — Apple’s 2025 flagship smartphone. With an investment of $2.8 billion (₹25,000 crore), the plant is now Foxconn’s second-largest unit outside China. This marks a turning point in global electronics manufacturing, as India moves from being merely a consumer market to a major production hub in Apple’s worldwide supply chain.

🏭 Foxconn’s Expansion in India

Foxconn (also known as Hon Hai Precision Industry) is Apple’s largest manufacturing partner globally. The Taiwanese electronics giant has steadily increased its presence in India over the last decade, starting with its unit in Sriperumbudur, Tamil Nadu, which has been assembling iPhones for several years.

The Bengaluru facility represents a significant leap. Unlike earlier plants that began with older iPhone models, this unit started directly with the iPhone 17 — Apple’s latest flagship. This demonstrates greater confidence in India’s capacity to handle complex, high-value production from day one.

Foxconn’s broader plans in India include building plants beyond smartphones (covering semiconductors and EV components), large hiring drives for engineers and technicians, and tighter alignment with government-backed electronics programs.

Think of Foxconn as the factory behind your iPhone. Until now, most iPhones were “Made in China.” Now, for the first time, India is producing Apple’s newest phone right from launch — not older models years later. It’s like India graduating from playing in the junior league to the main tournament.

📌 Key Facts About the Bengaluru Facility

The Devanahalli plant sits within an industrial corridor near Kempegowda International Airport (Bengaluru International Airport), giving it strong export and logistics access. Key specifications include:

- Location: Devanahalli, near Bengaluru, Karnataka

- Investment: $2.8 billion (₹25,000 crore)

- Product: iPhone 17, starting with small batches and scaling in phases

- Rank: Second-largest Foxconn unit outside China

- Jobs: Tens of thousands expected at full capacity (direct and indirect)

- Export Markets: Europe, Middle East, and Africa

Remember “DBK”: Devanahalli location, Bengaluru city, Karnataka state. Investment: ₹25,000 crore = $2.8 billion. This is Foxconn’s #2 largest facility outside China.

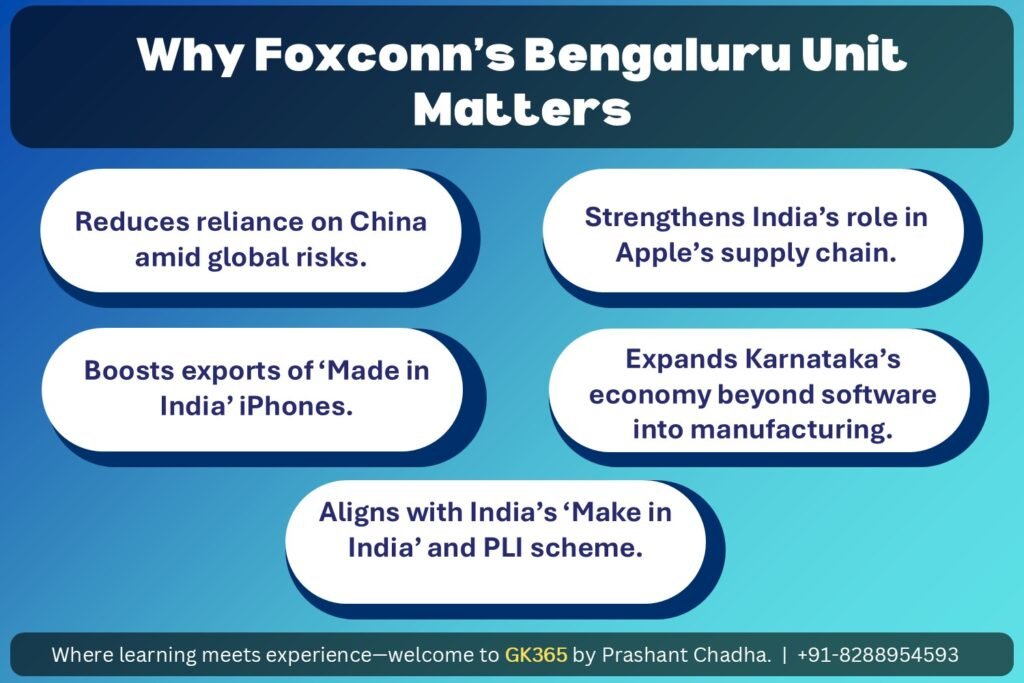

🌍 Strategic Importance of the Devanahalli Unit

The new factory strengthens Apple and Foxconn in several critical ways:

- Supply Chain Resilience: Reduces dependence on China during supply chain disruptions and geopolitical tensions

- Production Hub Status: Positions India as a key production center, not just a growing consumer market

- Employment Generation: Creates jobs across assembly, logistics, quality control, and support industries

- Export Potential: Enables “Made in India” iPhones to reach global markets

For Karnataka, the project elevates its profile beyond software services (Bengaluru’s IT sector), adding advanced hardware manufacturing to its economic portfolio.

| Aspect | Before (China-Centric) | After (India Hub) |

|---|---|---|

| Production Start | Older models only | Flagship from Day 1 |

| Supply Chain Risk | Single-country dependence | Diversified manufacturing |

| Export Markets | Limited from India | Europe, Middle East, Africa |

| India’s Role | Consumer market | Production + Consumer hub |

🍎 Apple’s Global Diversification Strategy

Apple has faced rising challenges in China, including pandemic-related disruptions (COVID-19 lockdowns) and increasing geopolitical tensions between the US and China. These events exposed the risks of concentrating production in a single country — a strategy known as “China Plus One.”

India offers Apple three clear advantages:

- Growing Market: A large and fast-growing iPhone consumer base

- Skilled Workforce: Engineers, technicians, and manufacturing talent

- Policy Support: Strong incentives through the Production Linked Incentive (PLI) scheme

Producing the iPhone 17 in India from its global launch shows Apple now treats India as central, not secondary, to its production network. This is a fundamental shift in Apple’s manufacturing philosophy.

Apple’s shift isn’t just about costs — it’s about survival. When COVID-19 shut down Chinese factories in 2022, Apple lost billions in sales. Now, having India as a backup (and eventually, a primary hub) means Apple can keep selling even if one region faces disruptions. It’s corporate risk management at its finest.

🏛️ Government Push & PLI Scheme

The Bengaluru project is part of India’s Production Linked Incentive (PLI) Scheme for Large Scale Electronics Manufacturing, launched in 2020. The scheme rewards companies based on incremental production and exports.

Government support has included:

- Fast-Track Approvals: Quick land acquisition and infrastructure clearances

- Financial Incentives: Cash incentives tied to production milestones and export volumes

- State Support: Karnataka government’s active role in developing the Devanahalli industrial zone

- Ease of Doing Business: Single-window clearances and dedicated liaison officers

These coordinated efforts have made India one of the top destinations for global electronics hardware firms looking to diversify from China.

Don’t confuse: PLI Scheme covers multiple sectors, not just electronics. For electronics, there are separate PLI schemes for (1) Large Scale Electronics Manufacturing (smartphones, laptops) and (2) IT Hardware. Foxconn benefits from the first one. Also, PLI is about production incentives, not subsidies for setting up factories.

💰 Economic Impact on Karnataka and India

The ripple effects of this investment extend far beyond the factory gates:

Employment:

- Thousands of direct jobs in assembly, engineering, and quality control

- Many indirect jobs in logistics, component supply, and local services

- Workforce training partnerships with technical institutes

Skill Development:

- Foxconn is working with training centers to equip workers with skills in precision electronics and automation

- Technology transfer and upskilling of local talent

Regional Growth:

- Bengaluru, already strong in IT services, now expands into advanced hardware manufacturing

- Development of ancillary industries and component suppliers around the facility

Export Potential:

- Over time, India could produce 20–25% of global iPhones

- iPhones built in Bengaluru will ship to Europe, Middle East, and Africa

⚡ Challenges Ahead

India faces several hurdles before it can fully scale to match China’s manufacturing dominance:

- Component Dependency: Many high-value parts (especially semiconductors and advanced displays) still come from abroad — China, Taiwan, South Korea

- Infrastructure Gaps: Power supply, logistics networks, and industrial systems need steady upgrades

- Labor Issues: Worker conditions and welfare must be monitored to avoid disputes (Foxconn has faced labor protests in the past)

- Competition: Vietnam and other Southeast Asian countries are also competing aggressively for Apple’s investments

- Scale Challenges: Building a complete ecosystem of suppliers takes years

How India addresses these challenges will determine its long-term role in global electronics supply chains.

The Foxconn story illustrates the classic “opportunity vs. challenge” framework. India has the opportunity (large market, PLI support, skilled workforce) but also faces challenges (infrastructure, component dependency, competition). A balanced analysis requires acknowledging both — and discussing specific policy solutions.

Click to flip • Master key facts

For GDPI, Essay Writing & Critical Analysis

5 questions • Instant feedback

Foxconn Bengaluru plant is located in Devanahalli, Karnataka, near Kempegowda International Airport.

The investment is $2.8 billion, which is approximately ₹25,000 crore.

The Bengaluru facility is Foxconn second-largest unit outside China.

The plant is producing iPhone 17, Apple 2025 flagship model, from its global launch.

The Production Linked Incentive (PLI) Scheme for Large Scale Electronics Manufacturing supports this investment.