Foxconn’s Bengaluru Plant Begins iPhone 17 Production, Becomes Second-Biggest Unit Outside China

Foxconn’s new factory in Bengaluru, Karnataka has started producing the iPhone 17. With an investment of $2.8 billion (₹25,000 crore), the Devanahalli plant is now Foxconn’s second-largest unit outside China. This move strengthens India’s role in Apple’s global supply chain and highlights Apple’s effort to reduce its reliance on China.

Table of Contents

- Foxconn’s Expansion in India

- Key Facts About the Bengaluru Facility

- Strategic Importance of the Devanahalli Unit

- Apple’s Global Diversification Strategy

- Government Push and Incentives

- Economic Impact on Karnataka and India

- Supply Chain and Export Potential

- Challenges Ahead

- What This Means for India’s Tech Future

- Conclusion

- Key Takeaways Table

Foxconn’s Expansion in India

Foxconn, Apple’s largest manufacturing partner, has steadily increased its presence in India over the last decade. Its unit in Sriperumbudur, Tamil Nadu has been assembling iPhones for several years.

The Bengaluru facility is a step further. Unlike earlier plants, which began with older models, this unit started directly with the iPhone 17, Apple’s 2025 flagship. This shows greater confidence in India’s ability to handle complex production.

Foxconn’s broader plans in India include:

- Building plants beyond smartphones, including semiconductors and EV parts.

- Large hiring drives for engineers, technicians, and factory staff.

- Tighter alignment with government-backed electronics programs.

Key Facts About the Bengaluru Facility

- Location: Devanahalli, near Bengaluru, Karnataka

- Investment: $2.8 billion (₹25,000 crore)

- Product: iPhone 17, starting with small batches and scaling in phases

- Rank: Second-largest Foxconn unit outside China

- Jobs: Tens of thousands expected at full capacity

The plant sits within an industrial corridor near Bengaluru International Airport, giving it strong export and logistics access.

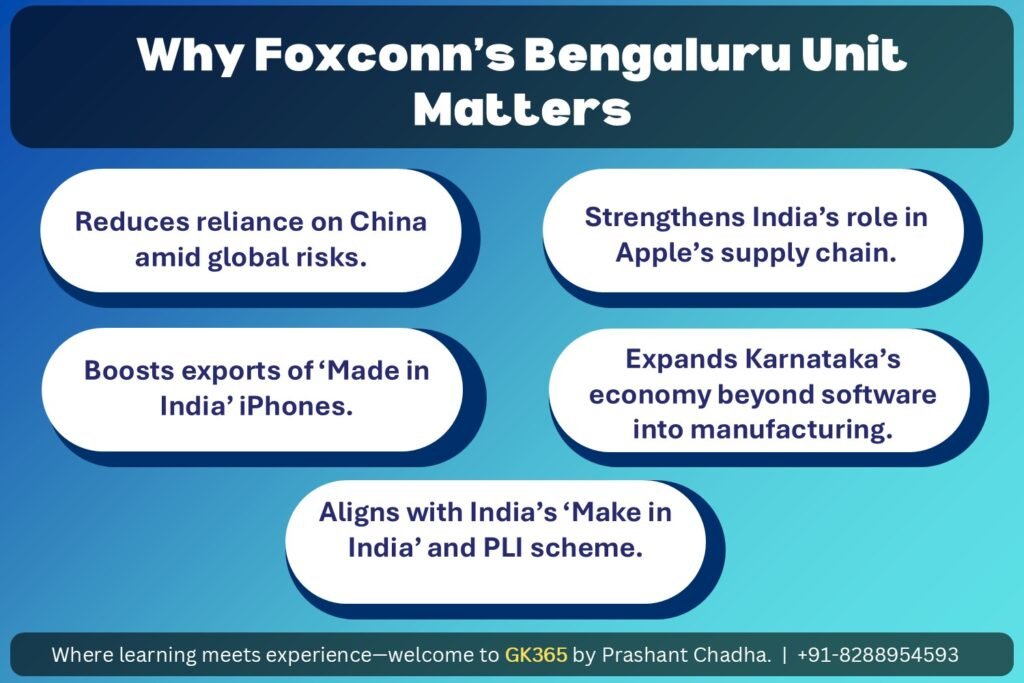

Strategic Importance of the Devanahalli Unit

The new factory strengthens Apple and Foxconn in several ways:

- Cuts reliance on China during supply chain and geopolitical risks.

- Positions India as a key production hub, not just a growing market.

- Creates jobs across assembly, logistics, and support industries.

- Provides export potential for “Made in India” iPhones.

For Karnataka, the project lifts its profile beyond software, adding advanced manufacturing to its economy.

Apple’s Global Diversification Strategy

Apple has faced rising challenges in China, including pandemic disruptions and geopolitical tension. These events exposed the risks of concentrating production in one country.

India offers Apple three clear advantages:

- A large and fast-growing iPhone market.

- Skilled engineers and technicians.

- Strong incentives through the Production Linked Incentive (PLI) scheme.

Producing the iPhone 17 in India from its global launch shows Apple now treats India as central, not secondary, to its production network.

Government Push and Incentives

The Bengaluru project is part of India’s PLI scheme, which rewards companies based on production and exports.

Support has included:

- Quick land and infrastructure approvals.

- Incentives tied to production and shipments.

- Help from Karnataka’s state government in developing the Devanahalli zone.

These steps have made India one of the top destinations for global hardware firms.

Economic Impact on Karnataka and India

- Jobs: Thousands of direct jobs in assembly, engineering, and quality checks. Many indirect jobs in logistics, parts, and local services.

- Skill Growth: Foxconn is working with training centers to equip young workers with skills in electronics and automation.

- Regional Growth: Bengaluru, already strong in IT, will now expand into advanced hardware manufacturing.

Supply Chain and Export Potential

The new plant aims to build a wider supply ecosystem in India. Local firms are already supplying chargers, packaging, and other parts.

Its location near Bengaluru International Airport makes it an export-ready hub. iPhones built here will ship to Europe, the Middle East, and Africa.

Over time, India could produce 20–25% of global iPhones, cementing its place in electronics manufacturing.

Challenges Ahead

India faces hurdles before it can fully scale:

- Many high-value parts, such as semiconductors, still come from abroad.

- Power, logistics, and industrial systems need steady upgrades.

- Worker conditions and welfare must be monitored to avoid disputes.

- Vietnam and other countries compete for Apple’s investments.

How India addresses these issues will shape its long-term role in global supply chains.

What This Means for India’s Tech Future

Foxconn’s Bengaluru unit signals a turning point:

- India moves from being a buyer of devices to a global producer.

- Apple shows trust in Indian factories by starting flagship production here.

- Local industries, from logistics to parts, will grow faster.

- “Made in India” iPhones raise India’s profile as a high-tech producer.

This aligns with India’s “Make in India” push and strengthens its case for self-reliance in technology.

Conclusion

The start of iPhone 17 production at Foxconn’s Bengaluru facility marks a milestone for India. Backed by $2.8 billion in investment, the Devanahalli plant is Foxconn’s second-largest site outside China.

It creates jobs, builds new skills, and boosts exports. Challenges remain in supply chains and infrastructure, but the direction is clear. India is becoming a major hub in global electronics manufacturing.

As iPhone 17 units roll out from Bengaluru, they reflect not just a product launch but a shift in global manufacturing geography, with India now at the center.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Location | Devanahalli, Bengaluru, Karnataka, near international airport for exports. |

| Investment | $2.8 billion (₹25,000 crore) making it Foxconn’s second-largest facility outside China. |

| Product | Starts directly with iPhone 17, Apple’s 2025 flagship model. |

| Jobs & Skills | Tens of thousands of direct and indirect jobs; workforce training in electronics and automation. |

| Strategic Importance | Reduces reliance on China; positions India as a core Apple hub. |

| Government Support | Backed by Production Linked Incentive (PLI) scheme and quick approvals. |

| Export Potential | Hub for shipments to Europe, Middle East, and Africa; India may reach 20–25% of global iPhone production. |

| Challenges | Dependence on imported parts, infrastructure gaps, and competition from Vietnam. |

| Tech Future | Strengthens India’s role from consumer market to global producer in electronics. |