GST Rate Cuts 2025: What’s Cheaper, What’s Costlier for Consumers

Table of Contents

- Overview and timeline

- What changed in the GST structure

- What gets cheaper: quick lists by category

- What may cost more

- How much can a household save

- Sector-wise impact

- Process reforms: registration and refunds

- What consumers and businesses should do now

- FAQs

- Key Takeaways Table

Overview and timeline

At its 56th meeting on 3 September 2025, the GST Council cleared major rate cuts. These take effect from 22 September 2025, just before the festive season. The Council also scrapped middle slabs and removed GST on health and life insurance.

What changed in the GST structure

India now uses two main slabs for most goods and services: 5% and 18%. A 40% rate applies to luxury and sin items. The old 12% and 28% slabs are gone. The government expects revenue loss of about ₹48,000 crore, while analysts see the cuts helping slow inflation.

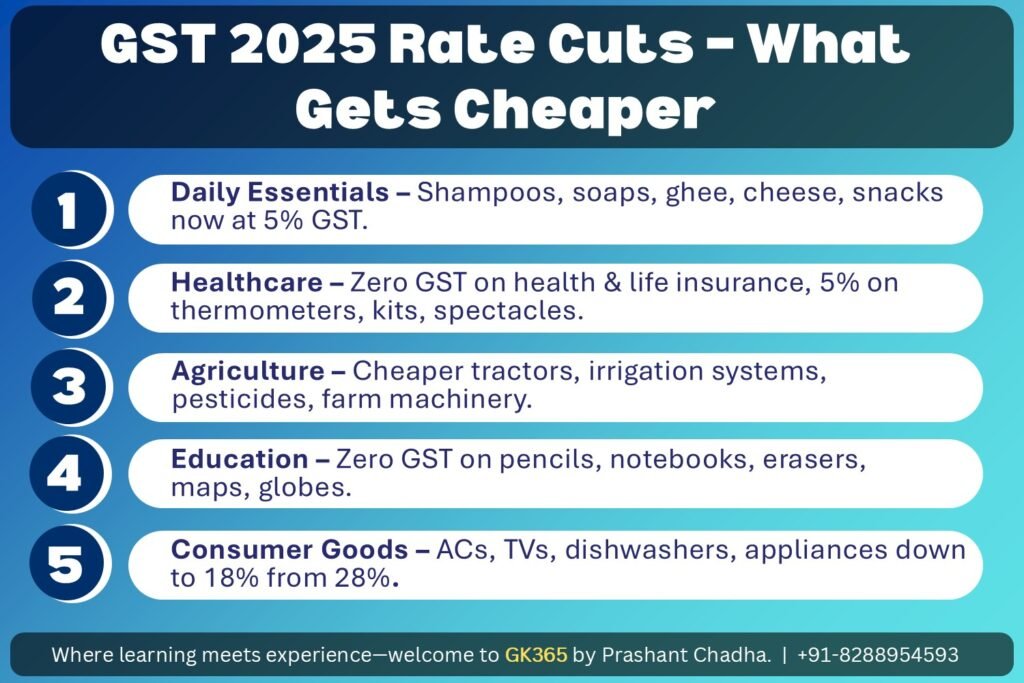

What gets cheaper: quick lists by category

Daily essentials

- Now at 5% (from 18%): Hair oil, shampoos, toothpaste, toilet soap bars, toothbrushes, shaving cream.

- Now at 5% (from 12%): Butter, ghee, cheese, condensed milk, dairy spreads, pre-packaged snacks like namkeens and chips, common kitchen utensils.

These cuts mean lower shelf prices from October. Some firms may pass benefits through larger packs.

Healthcare and medicines

- Zero GST: Health and life insurance.

- Now at 5%: Thermometers, medical oxygen, diagnostic kits, glucometers, corrective spectacles.

This reduces out-of-pocket costs and premium bills.

Farming and agri inputs

- Now at 5%: Tractors (down from 12%), tractor tyres and parts (down from 18%), drip irrigation systems, sprinklers, bio-pesticides, micro-nutrients, and farm machinery for soil work and harvesting.

Lower costs should support mechanisation and rural incomes.

Education and stationery

- Now at 0% (from 12%): Maps, globes, pencils, sharpeners, crayons, exercise books, notebooks, erasers.

This eases household education budgets.

Automobiles

- Now at 18% (from 28%): Small and mid-size petrol, CNG, LPG cars (≤1200 cc, ≤4000 mm), diesel cars (≤1500 cc, ≤4000 mm), motorcycles up to 350 cc, three-wheelers, and goods vehicles.

Luxury vehicles remain at 40%. EVs keep concessional rates.

Electronics and appliances

- Now at 18% (from 28%): Air conditioners, TVs above 32 inches, monitors, projectors, dishwashers, and other white goods.

The cut is timed for festive sales.

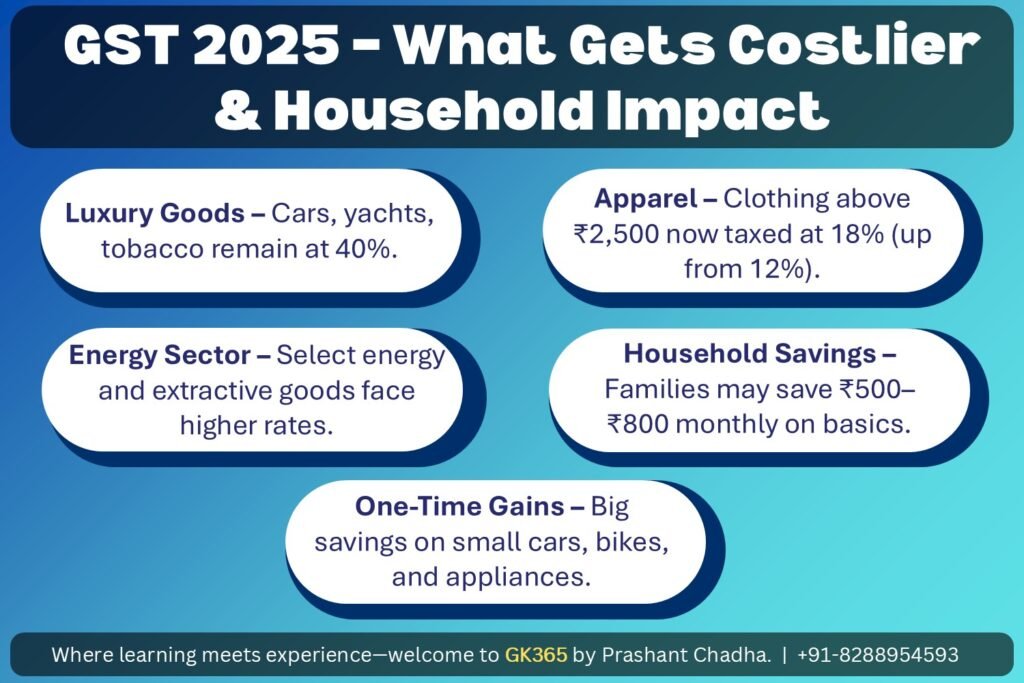

What may cost more

- 40% slab: Super-luxury cars, yachts, and sin goods like tobacco.

- Apparel above ₹2,500: Moved to 18% from 12%.

- Select energy and extractive items: Higher rates apply.

How much can a household save

Example for a family of four each month:

- Two shampoos at ₹200 → save ₹26.

- One ghee pack at ₹600 → save ₹40.

- Two toothpastes at ₹120 → save ₹26.

- Kitchen utensils worth ₹1,000 → save ₹66.

- Health insurance premium ₹2,000 → save ₹360.

Net gain: ₹500–₹800 monthly. A vehicle purchase brings one-time savings.

Sector-wise impact

- FMCG: Lower prices on soaps, shampoos, toothpaste, snacks should raise demand during Navratri.

- Healthcare: Zero GST on insurance reduces premium bills. Insurers may tweak prices later.

- Automobiles: Cuts should boost small car and bike sales. Luxury vehicles stay expensive.

- Agriculture: Cheaper tractors and irrigation gear support mechanisation.

- Consumer durables: Lower GST on ACs, TVs, and appliances can drive festive sales.

Process reforms: registration and refunds

The Council also approved compliance changes:

- Faster GST registration in three working days for low-risk cases.

- Quicker refunds for exporters and inverted duty cases.

- Pre-filled returns with better analytics to curb fraud and ease compliance.

What consumers and businesses should do now

Consumers

- Check new MRPs from late September.

- Look at insurance renewal notices for GST-free bills.

Businesses

- Update billing software for the new slabs.

- Revise contracts and quotes that mentioned 12% or 28%.

- Prepare refund claims with full documents.

FAQs

- When do new rates apply?

- From 22 September 2025.

- What are the new slabs?

- 5%, 18%, and 40%.

- Are small cars and bikes cheaper?

- Yes, rates drop to 18%.

- Is health insurance tax-free?

- Yes, from 22 September.

- Will shops cut prices right away?

- Many will, but new labels may take weeks.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Implementation Date | New rates apply from 22 September 2025, ahead of the festive season. |

| New GST Slabs | 5% and 18% for most items, 40% for luxury/sin goods. |

| What Gets Cheaper | Essentials, health insurance, farm equipment, education items, small cars, and appliances. |

| What Costs More | Luxury cars, yachts, tobacco, apparel above ₹2,500, select energy items. |

| Household Impact | Monthly savings of ₹500–₹800; bigger one-time savings on cars and appliances. |

| Sector Impact | FMCG, autos, agriculture, healthcare, and durables to benefit from demand boost. |

| Process Reforms | Faster GST registration, quicker refunds, pre-filled returns for compliance ease. |