JioFinance App’s New Tax Filing Module: Affordable, Smart, and TaxBuddy-Powered

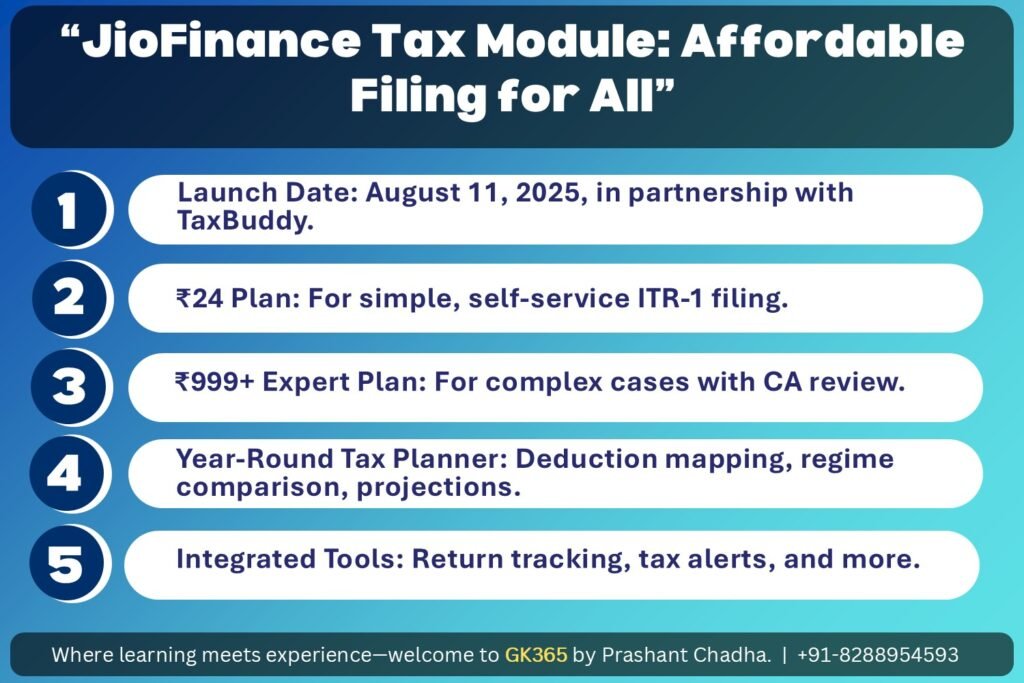

Jio Financial Services Ltd (JFSL) has added a tax planner and filing module to the JioFinance app, developed in partnership with TaxBuddy. Launched on August 11, 2025, the feature aims to make income tax filing simpler and cheaper. Users can file returns starting at ₹24, or opt for expert-assisted filing from ₹999.

Table of Contents

- Introduction

- Why JioFinance Entered the Tax Filing Space

- Feature Overview

- Benefits for Users

- Pricing Structure Explained

- Things to Know Before Filing

- How the TaxBuddy Partnership Strengthens the Module

- Market Impact and Competition

- Future Prospects of JioFinance as a Financial Super-App

- Conclusion

- Key Takeaways Table

Why JioFinance Entered the Tax Filing Space

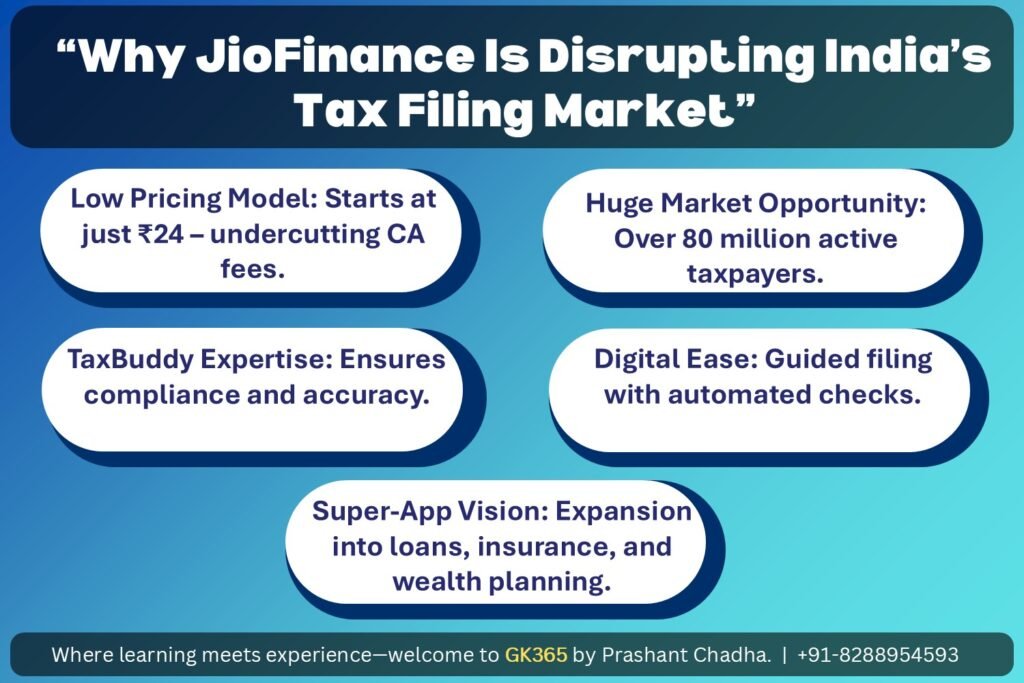

India has over 80 million active taxpayers, a number rising with digitization and tighter compliance. Filing returns is often stressful, especially for first-time users. Chartered accountant (CA) services cost between ₹2,000 and ₹5,000, which is steep for simple cases.

JioFinance addresses this gap by combining affordability with guided digital tools. Partnering with TaxBuddy ensures compliance and accuracy. Backed by Reliance’s ecosystem, JioFinance moves beyond payments into financial planning.

Feature Overview

Tax Planner

The built-in planner works year-round, not just at filing time.

- Deduction Mapping: Suggests deductions under sections like 80C and 80D.

- Regime Comparison: Shows savings under both tax regimes.

- Tax Projections: Forecasts liabilities in advance.

Tax Filing Options

- Self-Service Filing (₹24): A guided process for simple ITR-1 cases.

- Expert-Assisted Filing (₹999+): Includes document review, compliance checks, and advice.

Added Functionalities

- Return Tracker: Monitors status and refunds.

- Tax Alerts: Reminders about deadlines and notices.

Benefits for Users

- Low Cost: Filing starts at ₹24, well below CA charges.

- Ease: Step-by-step design helps first-time filers.

- Accuracy: Automated checks reduce errors.

- Year-Round Planning: Doubles as a tax management tool.

- Integration: Works within the JioFinance app alongside payments and savings.

Pricing Structure Explained

- ₹24 Plan: For salaried individuals with ITR-1. No expert review.

- ₹999 Plan: Professional review and advice for those with multiple income sources.

- Higher Tiers: For complex cases like audits, priced transparently before filing.

This tiered system lets users pay based on complexity.

Things to Know Before Filing

Scope of the ₹24 Plan

Covers only salaried individuals with simple returns. Business income, capital gains, or multiple properties require the higher tier.

Data Privacy Considerations

Filing requires PAN, Aadhaar, salary slips, and bank details. JioFinance and TaxBuddy must maintain strict encryption and compliance. Users should check privacy settings before submitting data.

When to Choose Expert Support

Users with stock trading, foreign income, multiple properties, or complex exemptions benefit from professional checks.

How the TaxBuddy Partnership Strengthens the Module

TaxBuddy brings experience in handling a range of tax cases, adding credibility to JioFinance’s offering. Jio provides reach and user-friendly design, while TaxBuddy ensures compliance expertise.

Market Impact and Competition

The tax filing market has been divided between high-cost CA services and online portals like ClearTax. With plans at ₹24 and ₹999, JioFinance sets new price pressure.

Competitors may struggle to match Jio’s scale. With millions of existing users, adoption could be rapid, pushing JioFinance into other areas such as insurance and wealth planning.

Future Prospects of JioFinance as a Financial Super-App

The tax module is part of JioFinance’s broader push to become a financial super-app. Beyond tax filing, future features may include:

- Loan management

- Mutual fund investments

- Insurance advice

- Retirement planning

By combining these, JioFinance can centralize services now spread across multiple apps.

Conclusion

The launch of the tax planner and filing module on JioFinance marks a shift in how Indians approach tax filing. The ₹24 plan makes filing affordable for simple cases, while the ₹999 plan offers professional oversight for complex returns.

The TaxBuddy partnership provides credibility, while Jio’s reach ensures scale. Challenges remain in privacy and complex filings, but the module positions JioFinance as a strong player in digital finance.

As more features are added, JioFinance could grow from a filing tool into a full financial planner for millions of Indians.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Launch Date | August 11, 2025, on the JioFinance app in collaboration with TaxBuddy. |

| Core Offering | Affordable tax filing starting at ₹24, with options for expert-assisted filing. |

| Tax Planner | Year-round tool for deduction mapping, tax regime comparison, and forecasting. |

| Pricing Structure | ₹24 for simple ITR-1 filings, ₹999+ for expert guidance on complex returns. |

| User Benefits | Low cost, simplicity, automated error-checking, and integrated tax management. |

| Target Audience | First-time filers, salaried individuals, and users needing cost-effective help. |